All Categories

Featured

Table of Contents

That usually makes them a much more economical option for life insurance coverage. Several people get life insurance protection to assist monetarily shield their enjoyed ones in situation of their unforeseen fatality.

Or you may have the option to transform your existing term insurance coverage right into an irreversible policy that lasts the remainder of your life. Various life insurance policy plans have possible advantages and downsides, so it's important to recognize each prior to you make a decision to buy a policy.

As long as you pay the premium, your beneficiaries will certainly obtain the fatality advantage if you pass away while covered. That stated, it is necessary to note that the majority of policies are contestable for two years which suggests insurance coverage can be retracted on fatality, must a misstatement be located in the application. Plans that are not contestable typically have a graded survivor benefit.

What is 20-year Level Term Life Insurance? All You Need to Know?

Costs are normally reduced than whole life policies. You're not locked right into a contract for the rest of your life.

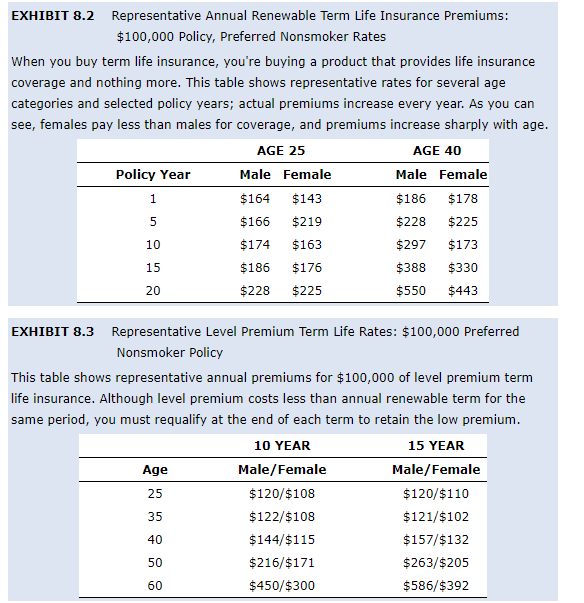

And you can't squander your plan during its term, so you will not get any type of economic advantage from your previous coverage. Similar to various other sorts of life insurance policy, the cost of a level term policy relies on your age, coverage requirements, employment, lifestyle and wellness. Commonly, you'll find more economical insurance coverage if you're more youthful, healthier and much less dangerous to guarantee.

Given that level term costs stay the very same throughout of insurance coverage, you'll know exactly just how much you'll pay each time. That can be a big aid when budgeting your expenses. Level term protection additionally has some versatility, allowing you to tailor your policy with additional features. These frequently come in the form of motorcyclists.

What is Level Term Life Insurance Definition Coverage?

You may have to fulfill certain conditions and credentials for your insurance company to enact this cyclist. On top of that, there might be a waiting duration of up to 6 months before taking effect. There also could be an age or time frame on the protection. You can include a kid cyclist to your life insurance policy plan so it also covers your youngsters.

The death advantage is normally smaller sized, and protection generally lasts up until your youngster transforms 18 or 25. This motorcyclist may be a much more economical method to help ensure your kids are covered as bikers can commonly cover multiple dependents at once. As soon as your kid ages out of this protection, it may be feasible to transform the cyclist right into a brand-new plan.

The most common type of irreversible life insurance coverage is entire life insurance, yet it has some key differences contrasted to degree term coverage. Here's a fundamental review of what to take into consideration when contrasting term vs.

What is Decreasing Term Life Insurance? Important Insights?

Whole life entire lasts for life, while term coverage lasts insurance coverage a specific periodDetails The premiums for term life insurance are normally reduced than entire life insurance coverage.

Among the highlights of level term insurance coverage is that your costs and your survivor benefit don't alter. With decreasing term life insurance policy, your costs continue to be the same; however, the death advantage amount obtains smaller with time. You may have protection that begins with a fatality advantage of $10,000, which could cover a mortgage, and then each year, the fatality advantage will certainly reduce by a set amount or percentage.

Because of this, it's typically a much more budget-friendly kind of degree term protection. You may have life insurance policy with your employer, however it might not be sufficient life insurance policy for your demands. The initial step when getting a policy is determining just how much life insurance you require. Consider factors such as: Age Household size and ages Work status Income Financial debt Way of living Expected final expenses A life insurance policy calculator can assist identify just how much you require to start.

What is 20-year Level Term Life Insurance? Understanding Its Purpose?

After determining on a plan, complete the application. If you're accepted, sign the documents and pay your initial premium.

You may desire to update your beneficiary information if you have actually had any type of significant life changes, such as a marriage, birth or divorce. Life insurance coverage can in some cases feel complicated.

No, degree term life insurance coverage does not have cash money worth. Some life insurance coverage policies have an investment function that allows you to develop money value over time. A part of your premium payments is alloted and can make rate of interest with time, which grows tax-deferred throughout the life of your coverage.

You have some choices if you still want some life insurance protection. You can: If you're 65 and your coverage has actually run out, for example, you may desire to purchase a brand-new 10-year degree term life insurance coverage plan.

What Are the Benefits of Level Term Life Insurance Meaning?

You may be able to convert your term coverage right into an entire life plan that will last for the remainder of your life. Many kinds of level term plans are exchangeable. That means, at the end of your protection, you can transform some or all of your policy to entire life insurance coverage.

A level costs term life insurance policy plan lets you adhere to your spending plan while you help shield your household. Unlike some stepped price strategies that boosts each year with your age, this kind of term strategy uses rates that stay the same through you choose, even as you get older or your health adjustments.

Learn more concerning the Life insurance policy alternatives available to you as an AICPA participant (Term life insurance for couples). ___ Aon Insurance Policy Solutions is the trademark name for the brokerage and program administration operations of Affinity Insurance policy Solutions, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Fondness Insurance Coverage Firm, Inc. (CA 0795465); in Okay, AIS Fondness Insurance Policy Solutions Inc.; in CA, Aon Affinity Insurance Coverage Solutions, Inc .

Latest Posts

Which Is The Best Funeral Plan

Final Expense Life Insurance No Waiting Period

Final Expense Protect Life Insurance