All Categories

Featured

Table of Contents

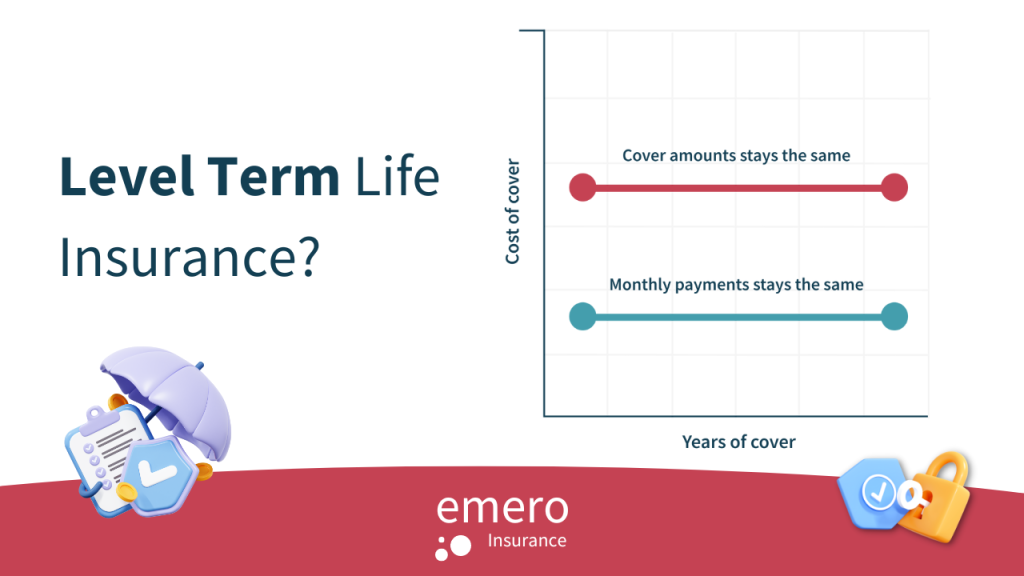

A degree term life insurance policy plan can offer you tranquility of mind that the individuals that rely on you will have a fatality benefit during the years that you are planning to sustain them. It's a means to help look after them in the future, today. A degree term life insurance policy (occasionally called level premium term life insurance policy) policy supplies insurance coverage for a set number of years (e.g., 10 or 20 years) while keeping the premium payments the same for the duration of the plan.

With degree term insurance policy, the expense of the insurance coverage will certainly stay the very same (or potentially lower if returns are paid) over the term of your policy, generally 10 or 20 years. Unlike permanent life insurance coverage, which never expires as long as you pay costs, a degree term life insurance policy plan will certainly end at some time in the future, commonly at the end of the duration of your level term.

What is Level Term Life Insurance Policy? A Guide for Families?

Due to this, many individuals make use of irreversible insurance policy as a steady economic preparation device that can serve numerous requirements. You may have the ability to transform some, or all, of your term insurance coverage throughout a set period, generally the first ten years of your policy, without requiring to re-qualify for protection even if your health has transformed.

As it does, you may wish to contribute to your insurance coverage in the future. When you first get insurance policy, you may have little savings and a big mortgage. Ultimately, your financial savings will certainly expand and your home mortgage will certainly shrink. As this happens, you might desire to at some point lower your fatality benefit or think about converting your term insurance policy to a permanent policy.

Long as you pay your costs, you can relax easy understanding that your liked ones will certainly obtain a death benefit if you die throughout the term. Numerous term plans allow you the capability to transform to long-term insurance coverage without having to take one more health test. This can allow you to capitalize on the extra advantages of a long-term plan.

Level term life insurance policy is just one of the simplest courses into life insurance policy, we'll talk about the benefits and drawbacks so that you can pick a strategy to fit your demands. Degree term life insurance policy is one of the most usual and standard form of term life. When you're searching for momentary life insurance plans, level term life insurance coverage is one path that you can go.

The application procedure for degree term life insurance policy is usually very simple. You'll complete an application which contains general individual info such as your name, age, etc in addition to a much more comprehensive questionnaire regarding your medical background. Relying on the policy you have an interest in, you may need to take part in a clinical exam procedure.

The brief solution is no., for example, let you have the convenience of fatality benefits and can accrue cash money value over time, implying you'll have more control over your benefits while you're to life.

What is Term Life Insurance Level Term? A Guide for Families?

Bikers are optional provisions included in your plan that can provide you fringe benefits and defenses. Riders are a terrific means to add safeguards to your policy. Anything can occur over the program of your life insurance coverage term, and you wish to await anything. By paying simply a little bit extra a month, bikers can supply the assistance you need in instance of an emergency.

This rider gives term life insurance policy on your kids via the ages of 18-25. There are instances where these advantages are built into your policy, yet they can additionally be available as a different enhancement that calls for added payment. This motorcyclist offers an additional death benefit to your beneficiary must you die as the result of a crash.

Latest Posts

Reputable A Whole Life Policy Option Where Extended Term Insurance Is Selected Is Called

Is Mortgage Insurance Mandatory

Private Protection Insurance