All Categories

Featured

Table of Contents

- – How Does Joint Term Life Insurance Help You?

- – Key Features of Increasing Term Life Insurance...

- – What is the Function of Level Term Life Insur...

- – The Basics: What is What Does Level Term Life...

- – What is Joint Term Life Insurance Coverage?

- – What is Voluntary Term Life Insurance? Find ...

- – What is What Does Level Term Life Insurance ...

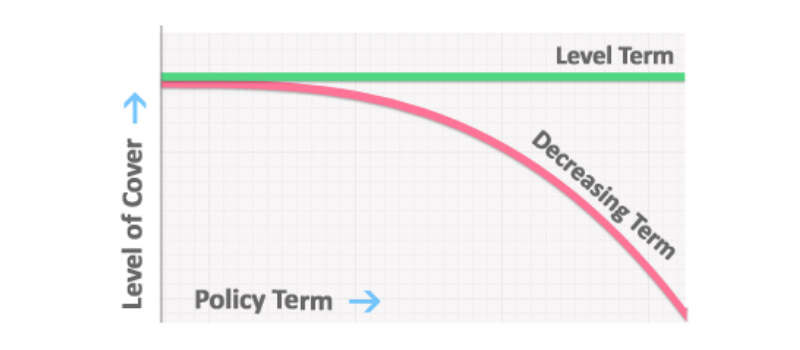

With this kind of degree term insurance coverage, you pay the very same regular monthly costs, and your recipient or beneficiaries would certainly get the same advantage in case of your fatality, for the entire protection duration of the policy. So how does life insurance coverage operate in terms of cost? The price of degree term life insurance policy will certainly rely on your age and health in addition to the term size and insurance coverage quantity you choose.

Life: AgeGenderFace AmountTerm LengthPremium30Male$500,00030$29.9930 Woman$1,000,00030$43.3135 Man$500,00020$20.7235 Female$750,00020$23.1340 Male$600,00015$22.8440 Female$800,00015$27.72 Quote based on prices for eligible Haven Simple applicants in excellent health and wellness. No matter of what protection you choose, what the policy's money worth is, or what the swelling sum of the fatality advantage transforms out to be, tranquility of mind is among the most useful benefits linked with acquiring a life insurance coverage policy.

Why would certainly somebody choose a policy with an each year eco-friendly premium? It might be a choice to consider for a person who needs protection only momentarily.

How Does Joint Term Life Insurance Help You?

You can generally renew the policy every year which offers you time to consider your options if you want insurance coverage for longer. Understand that those alternatives will certainly involve paying greater than you used to. As you grow older, life insurance policy premiums become dramatically a lot more costly. That's why it's practical to acquire the appropriate amount and size of insurance coverage when you initially obtain life insurance coverage, so you can have a low price while you're young and healthy.

If you contribute important unpaid labor to the home, such as child care, ask on your own what it might cost to cover that caretaking work if you were no more there. After that, see to it you have that protection in place to make sure that your household obtains the life insurance coverage advantage that they need.

Key Features of Increasing Term Life Insurance Explained

Does that suggest you should constantly select a 30-year term size? In general, a much shorter term plan has a lower costs price than a longer policy, so it's smart to select a term based on the predicted size of your economic obligations.

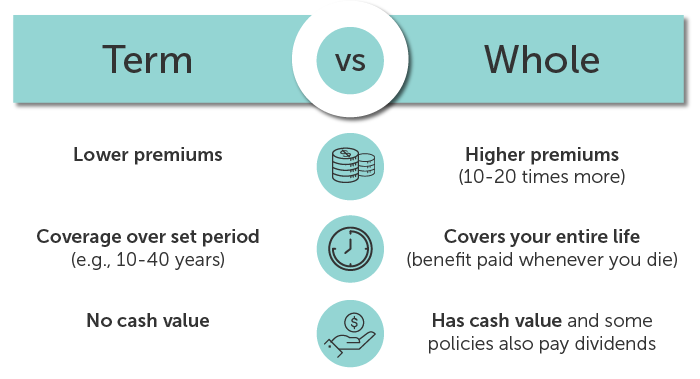

These are very important variables to maintain in mind if you were thinking of choosing an irreversible life insurance such as a whole life insurance policy. Lots of life insurance policy plans give you the alternative to add life insurance policy motorcyclists, believe added benefits, to your plan. Some life insurance policy policies feature bikers built-in to the price of costs, or cyclists may be offered at an expense, or have actually fees when exercised.

What is the Function of Level Term Life Insurance Policy?

With term life insurance policy, the communication that most individuals have with their life insurance policy company is a monthly bill for 10 to three decades. You pay your regular monthly premiums and hope your family members will never need to utilize it. For the team at Haven Life, that felt like a missed chance.

Our team believe browsing decisions concerning life insurance policy, your individual financial resources and overall wellness can be refreshingly basic (Decreasing term life insurance). Our content is created for academic purposes only. Haven Life does not back the business, items, solutions or methods talked about below, but we wish they can make your life a little much less hard if they are a fit for your situation

This product is not planned to provide, and must not be depended on for tax obligation, lawful, or financial investment advice. Individuals are urged to seed recommendations from their very own tax obligation or legal advise. Read even more Place Term is a Term Life Insurance Policy Plan (DTC and ICC17DTC in particular states, including NC) issued by Massachusetts Mutual Life Insurance Business (MassMutual), Springfield, MA 01111-0001 and offered solely with Place Life Insurance Policy Firm, LLC.

The rating is as of Aril 1, 2020 and is subject to change. Sanctuary Life And Also (Plus) is the advertising and marketing name for the And also motorcyclist, which is consisted of as part of the Place Term policy and provides access to added solutions and advantages at no cost or at a discount rate.

The Basics: What is What Does Level Term Life Insurance Mean?

Discover more in this guide. If you depend upon somebody monetarily, you could question if they have a life insurance policy plan. Learn how to discover out.newsletter-msg-success,. newsletter-msg-error display: none;.

When you're younger, term life insurance policy can be a straightforward means to shield your enjoyed ones. But as life modifications your financial priorities can too, so you may intend to have entire life insurance policy for its life time protection and extra advantages that you can utilize while you're living. That's where a term conversion is available in.

What is Joint Term Life Insurance Coverage?

Authorization is guaranteed no matter your wellness. The premiums won't raise once they're set, but they will rise with age, so it's an excellent idea to secure them in early. Learn extra about exactly how a term conversion functions.

Words "level" in the phrase "level term insurance" suggests that this type of insurance has a fixed costs and face amount (death advantage) throughout the life of the policy. Put simply, when people discuss term life insurance policy, they commonly describe level term life insurance policy. For most of individuals, it is the most basic and most economical choice of all life insurance policy types.

What is Voluntary Term Life Insurance? Find Out Here

Words "term" below refers to a provided number of years during which the level term life insurance policy remains energetic. Level term life insurance coverage is among the most preferred life insurance policy policies that life insurance service providers supply to their clients as a result of its simpleness and cost. It is additionally simple to compare level term life insurance policy quotes and get the very best premiums.

The system is as adheres to: Firstly, pick a policy, survivor benefit quantity and policy duration (or term size). Select to pay on either a monthly or yearly basis. If your early demise happens within the life of the policy, your life insurance firm will pay a lump sum of survivor benefit to your determined recipients.

What is What Does Level Term Life Insurance Mean? Learn the Basics?

Your degree term life insurance coverage plan expires once you come to the end of your plan's term. At this point, you have the adhering to alternatives: Choice A: Keep without insurance. This option matches you when you can insure by yourself and when you have no debts or dependents. Choice B: Purchase a brand-new degree term life insurance policy policy.

2 Cost of insurance policy prices are identified utilizing methodologies that vary by business. It's vital to look at all elements when assessing the general competition of rates and the value of life insurance policy protection.

Table of Contents

- – How Does Joint Term Life Insurance Help You?

- – Key Features of Increasing Term Life Insurance...

- – What is the Function of Level Term Life Insur...

- – The Basics: What is What Does Level Term Life...

- – What is Joint Term Life Insurance Coverage?

- – What is Voluntary Term Life Insurance? Find ...

- – What is What Does Level Term Life Insurance ...

Latest Posts

Which Is The Best Funeral Plan

Final Expense Life Insurance No Waiting Period

Final Expense Protect Life Insurance

More

Latest Posts

Which Is The Best Funeral Plan

Final Expense Life Insurance No Waiting Period

Final Expense Protect Life Insurance